Author: Karl Schamotta, Chief Market Strategist, Corpay

The loonie is lifting off.

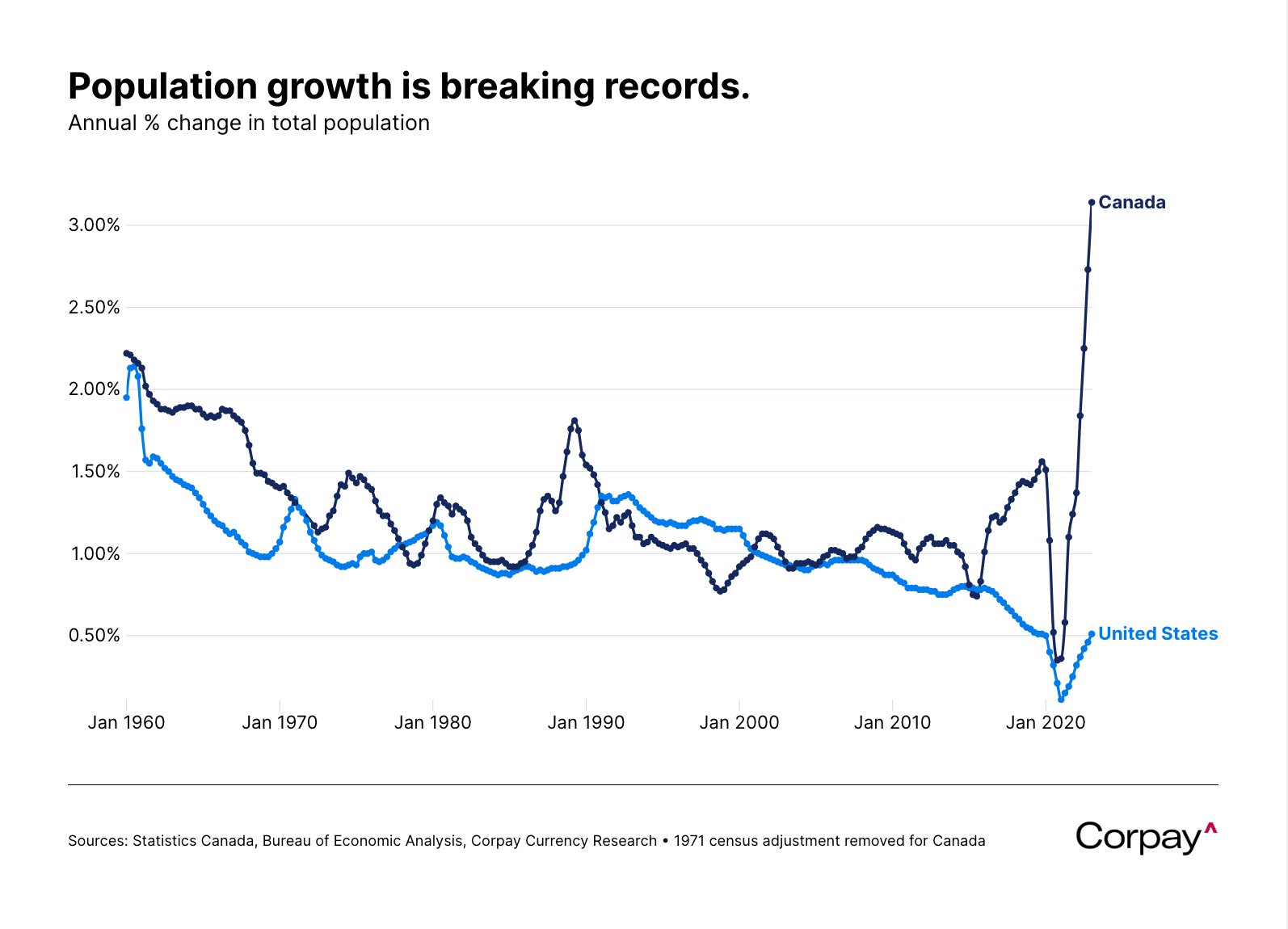

Fiscal support, stabilising financial conditions, and a historic surge in immigration are helping the Canadian economy - and the loonie - defy bearish expectations. Continued labour market tightness, rebounding housing markets, and high levels of consumer consumption have combined to deliver remarkably-robust growth rates. Although the Bank of Canada's latest Business Outlook Survey showed excess demand and labour shortages coming down to pre-pandemic levels, its Consumer Expectations Survey revealed an improvement in household confidence, with many respondents expecting wages to rise, interest rates to fall, and home prices to climb over the coming year.

The central bank has responded to signs of excess demand-fuelled inflation with a second round of rate hikes, and investors are currently putting 45-percent odds on another move by the October meeting - with rate cuts seen coming later, and at a more measured cadence than in the United States. Interest rate differentials have narrowed sharply from their peaks, and - although its gains look less impressive in nominal terms - the loonie is outperforming many of its counterparts against the greenback.

Yield differentials might narrow – or even flip.

Many things could go right for the Canadian economy in the months ahead. Housing markets have the potential to go from strength to strength as immigration flows lift demand and elevated financing rates limit the supply response from builders and existing homeowners. High and stable equity market valuations may support household wealth effects. Aggregate nominal household incomes might keep rising as persistent labour market imbalances put upward pressure on wages. And exports could hold up, particularly if the US consumption engine keeps running and a comprehensive stimulus effort from Chinese policymakers supports global commodity demand.

The Bank of Canada - which already sounds more confident than many of its global counterparts - could cut rates more gradually than the Federal Reserve in 2024, contributing to a narrowing in relative rate differentials and providing additional support to the currency.

But household consumption looks fragile.

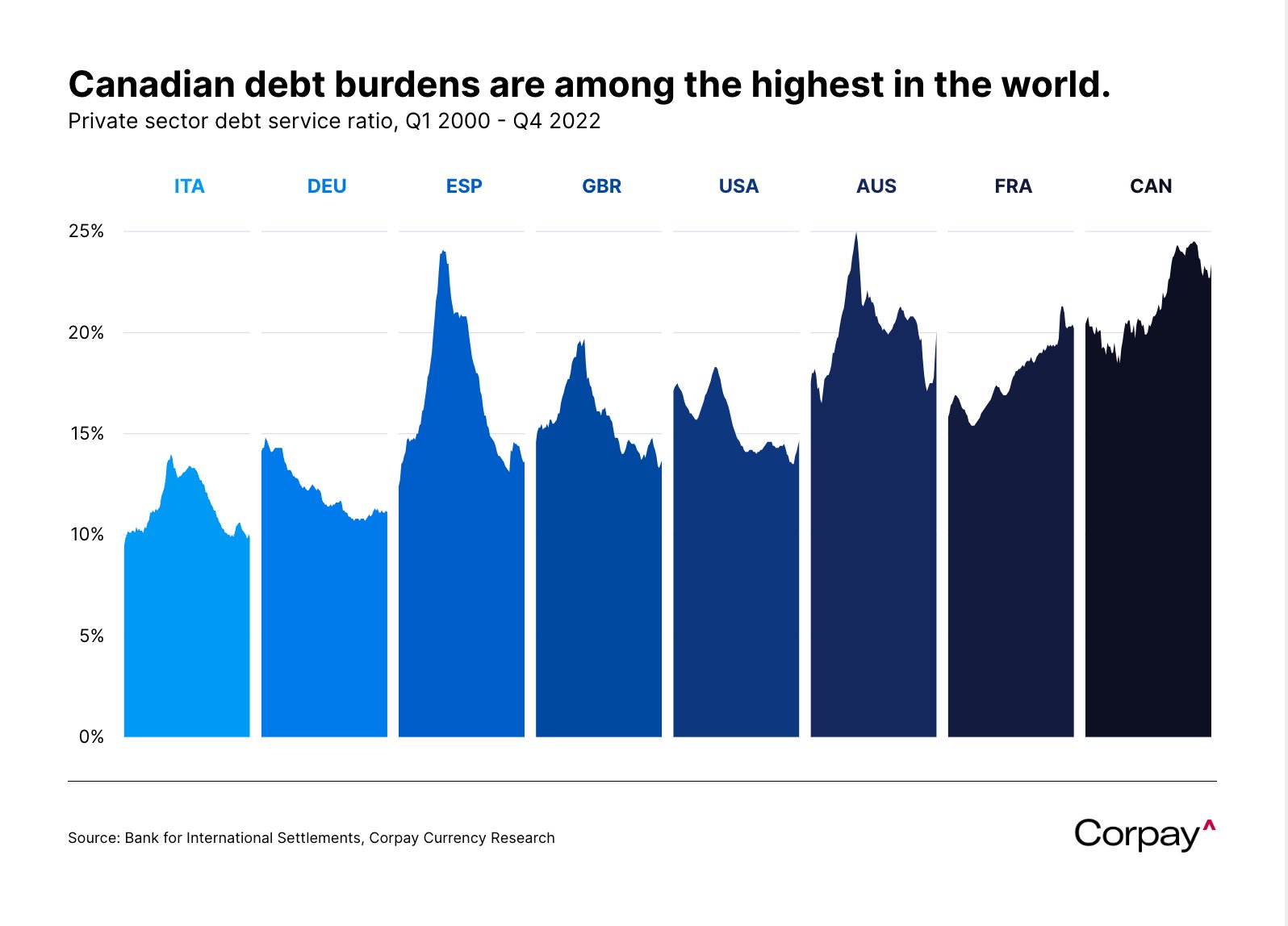

Canada’s incredibly-indebted private non-financial sector remains its biggest point of vulnerability. With long-term rates ratcheting higher and the burden on mortgage holders continuing to increase, debt service ratios are set to climb well above records set just before the pandemic. We think this will reduce consumer spending power and business investment at a time when real income growth is fading and lending conditions are tightening. A recent recovery in real estate values is likely to pull new listings into the market, just as rising carrying costs cool demand. This should limit further price appreciation and reduce the likelihood of a “melt-up” in housing activity that leads to overheating in the wider economy.

More broadly, lending conditions are tightening, job openings have fallen sharply from last year’s peak, and wage growth is slowing. We think a downturn is overwhelmingly likely to begin within the next 12 months, with consumer spending vulnerable to a significant downward adjustment as the elements of a balance sheet recession come into play. If so, the Bank of Canada could pivot more profoundly than markets currently anticipate, meaning that recent moves in yields and the Canadian dollar could unwind rather sharply.

And the loonie might follow a multi-phased trajectory.

Taken in sum, a prolonged period of calm could see the Canadian dollar rally in the short term, outperforming regions that are facing more obvious structural challenges - like the United Kingdom, the euro area, Japan, and China - in capitalizing on dollar weakness. But growth risks, comparatively low yields, and volatility sensitivities - particularly relative to US equity markets - should represent serious headwinds for the exchange rate beyond the early autumn.

For more information on Corpay global payment solutions, please visit https://www.corpay.com/cross-border/global-payments.

Karl Schamotta, Chief Market Strategist, Corpay